LIC Initial Public Offering: Decoded

As India’s economic growth slumps to 4.5% amid worldwide recession and a global pandemic, Finance Minister of India, Mrs. Nirmala Sitharaman, presented the Union Budget for FY21 on 1st February with the three themes: Aspirational India, Economic Development and Caring Society. This is the third year in row in which India has failed to meet its fiscal deficit target so one of 3.5% of GDP, seems a little too ambitious. The country is looking at major structural changes to revive growth.

In order to raise funds to meet the deficit, the Government plans to sell a part of its stake in LIC, through an IPO in the second half of the financial year ending in March 2021. LIC, completely owned by the Government of India, is the largest financial institution in India. This move will bring huge funds to the government and help meet a significant portion of the disinvestment target of Rs. 2.1 lakh crore. It would also give retail investors an opportunity to participate in the wealth so created. LIC will follow the lead of Recent IPOs of Rail Vikas Nigam, IRCTC and Bharat ETF which cumulatively raised around Rs. 21,000 crores. The Government also aims to privatise Air India and BPCL along with disinvestments of many other such corporations including Concor, Shipping Corporation of India and Neepco.

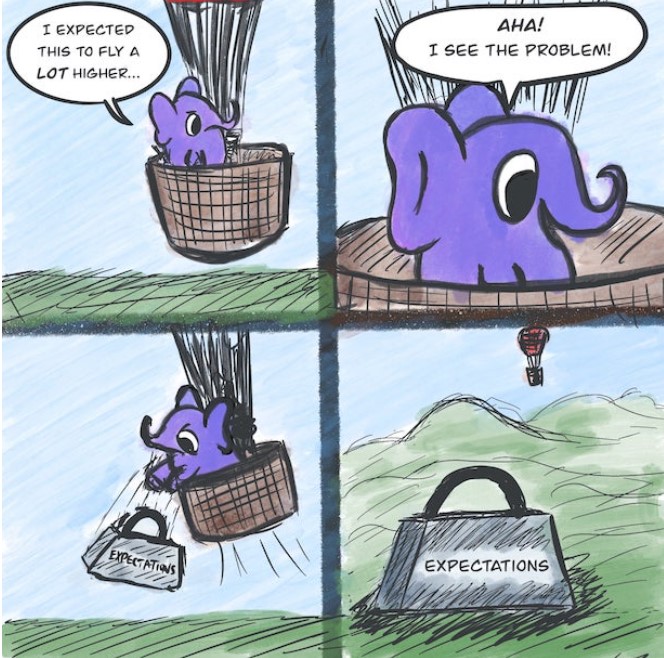

However such disinvestment initiatives are often viewed through a lens of nationalism which overpowers business prudence, with the government facing criticism for reducing their stake in public sector units while it’s still viable. Addressing this myth, listing of a company does not mean privatization as long as the government’s stake is more than 50%. The IPO becomes all the more important when one considers the crucial role that the LIC plays for the government by providing it with the financial backing clout to complete a large number of corporate bail-outs and provide it with the funds to enact fiscal stability measures and potentially even bail the government out in certain cases. With its listing, that may become more complicated for the government.

With total investments of 28,01,483 crore in the 13th five-year plan, LIC is the largest institutional investor in India, further highlighting its strength as an institution for the government. On the other hand, this poses a risk for investors as they have to account for not only the risks present in the insurance industry in India, but also country risks, accounting for potential bailout packages.

From the investors standpoint, not everything indicates a rosy picture for LIC as it is also a company that faces a great deal of statutory exposure, such as the detrimental impact of the removal of tax deductions in the current budget on LICs insurance book.

Over the years, there has been a steady increase in the NPA levels at LIC which have further been accentuated by the decline of the NBFC sector in India. Currently, LIC has NPAs of around Rs. 31 lakh crores as it had become the government’s financing arm. This might change as listing of LIC will ensure more transparent and regular disclosure of its investments and loan portfolios. Hence, this would not only provide the government with the much needed funds, but would bring good governance to LIC and other such corporations. Furthermore, it is important to understand the statutory environment around LIC which is governed by the provisions of the LIC Act 1956. Attributed to the large base of policyholders of LIC is the sovereign guarantee attached to it, as mentioned in the act. Another section reserves only 5% of the surplus to be distributed as dividends. Amendments to these sections hold the key to make the IPO more lucrative for investors.

Furthermore, as another reminder of its commitment to make the activities of the LIC more transparent it should allow all decisions with respect to the utilization of surplus to the shareholders. Although this will probably not impact the end decision as the government still maintains a majority shareholding but it will reduce some of the statutory opaqueness around LIC.